The pace of change is faster than ever. A company’s valuation may fluctuate by billions of dollars in a matter of milliseconds. We are expected to respond to myriads of nudges almost immediately. Thirty-second elevator pitches may dramatically change one’s career direction. In an environment where ups and downs occur so swiftly, we want to remind everyone interested in adopting a more venture-minded approach of the importance of long-term thinking. Therefore, this newsletter is all about …

PATIENCE

The mention of startups often brings to mind scenes of bustling activity and rapid decision making. Should you ever visit Silicon Valley, you would immediately sense this pace. Fast thinking, quick decisions, and swift results dominate the landscape.

However, the people who find and fund these fast-paced, innovative companies exhibit great patience. They understand that good things take time. Recognizing the value of patience is one of the first steps to becoming more innovative, both as an organization and individually.

Receive The Venture Mindset newsletter first. Subscribe now

1. How long does it take for unicorns to exit?

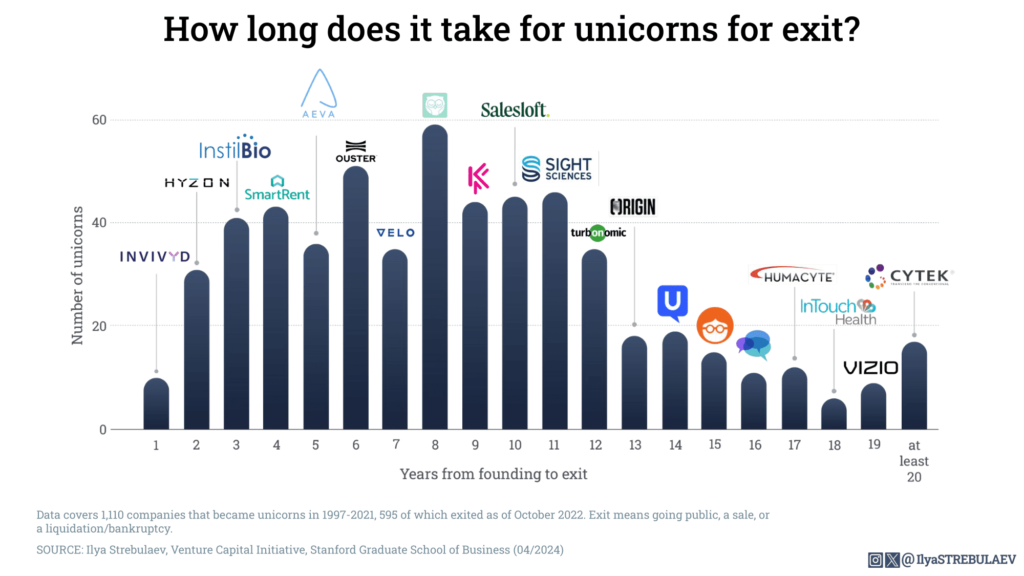

Funding and building a unicorn takes time, and venture investors are notably patient, willing to wait years for their efforts and capital to yield returns.

A study of 595 US VC-backed unicorns revealed that, on average, the time frame from founding to exit is 8 years. Here, “exit” refers to either going public, being acquired, or undergoing liquidation/bankruptcy.

There is a lot of variation. Some companies exit much faster. YouTube had a one-year turnaround from its 2005 founding to its 2006 acquisition by Google. Groupon also had an early exit just three years after its founding in 2008, and after turning down an even earlier acquisition opportunity. Invivyd went public in the summer of 2021, a little over a year after it was founded, having already raised Series A, B, and C.

On the other hand, some companies had to wait a long time. Galileo Financial Technologies went public after about 20 years, and Cytek Biosciences took 29.

However, in general VCs expect 8-10 years. Does your organization have similar time horizons in mind? Are you personally patient enough? Have you made bets that may be paid back a decade from now? Maybe it is time to make a few longer-term bets. We’ve personally made a few ourselves (one of which we mention at the end of this newsletter).

2. Are corporations patient enough?

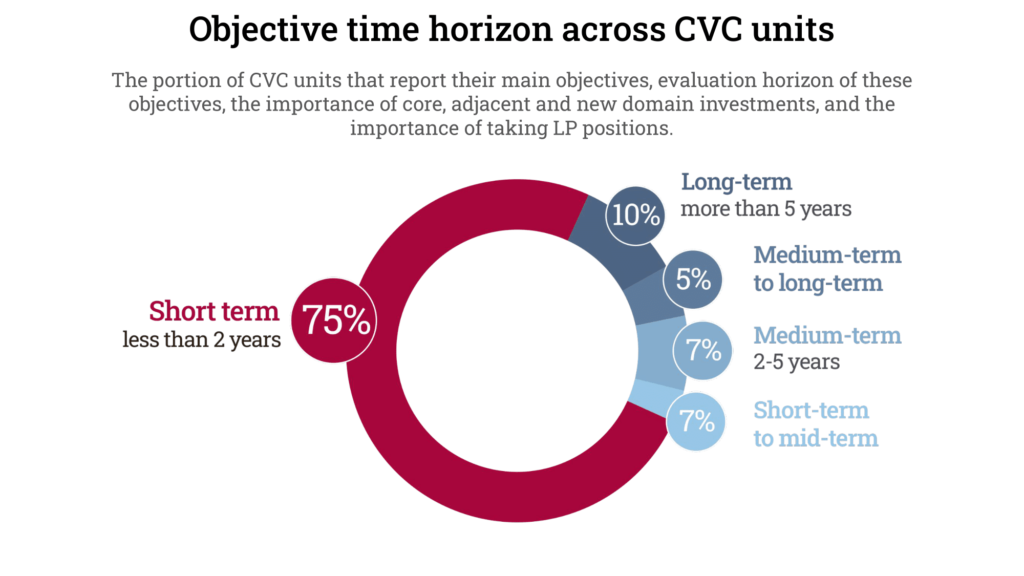

In contrast to traditional VC initiatives, corporate venture capital (CVC) programs within corporations often exhibit strikingly different time horizons. Their focus is frequently short-term, with an urgency to see results quickly—perhaps too quickly.

This short-term outlook is understandable, since most publicly traded companies are under pressure to deliver results in the next quarter or even the next month. However, having such a narrow focus can sideline many disruptive and innovative initiatives. These are often dismissed not only due to the level of risk involved but also because the timeline to fruition may be longer than the corporation is willing to wait.

Only a handful of organizations have successfully overcome this propensity for short-termism. Courage and wisdom are required to steer an organization toward extending its time horizons, recognizing that true innovation often needs time to mature and deliver substantial returns.

3. The quote

Long-term thinking changes how we behave. It makes us more willing to incur short-term losses. Patience and long-term thinking free the mind from unnecessary limitations and push us to think about what might happen to the world in 5, 10, or 15 years.

Amazon and other venture-minded organizations that have successfully launched new businesses from within have demonstrated the benefits of long-term, patient thinking numerous times. Think of AWS, cashier-less stores, the marketplace business, and the Prime loyalty program. These businesses required time to develop from the ground up, yet they have become powerful engines of growth.

4. On long-term trends in innovation

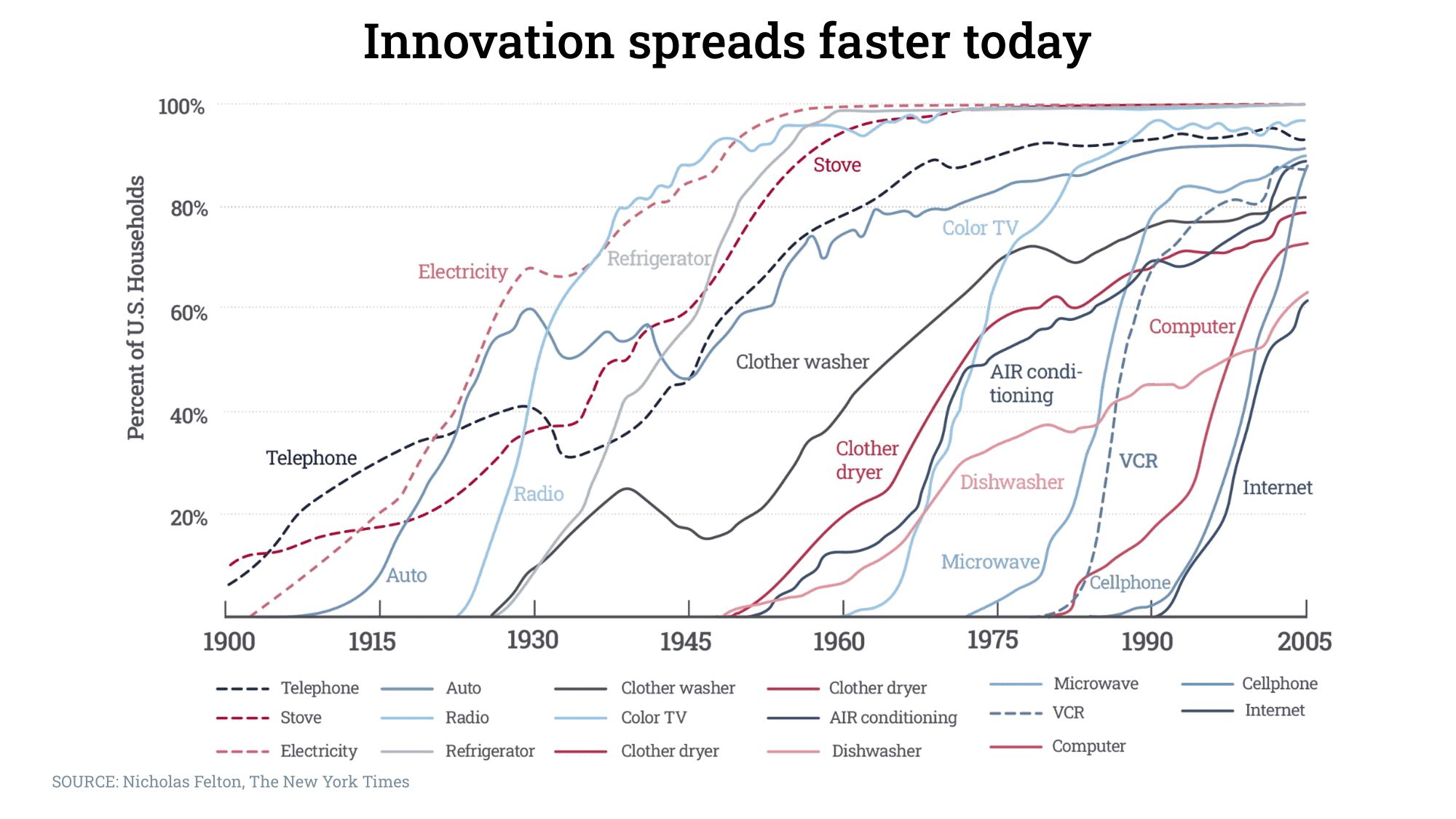

In our workshops, one of the first slides we present focuses on long-term trends and the adoption rates of new technologies. It took more than 65 years for electricity to reach 90 percent of US houses. The telephone was a luxury accessible to only one-quarter of Americans even after 35 years of its commercial availability.

This historical perspective illustrates the acceleration in the adoption of new technologies over time. Yet it also emphasizes that such adoption does not occur overnight, often taking years or decades rather than months. Expecting immediate impact from truly transformative technologies, ideas, products, or companies would be naïve. Innovation requires time—not just to be built, but also to be widely adopted.

5. A peek into the book

Patience and long-term thinking are so important that we dedicated a whole chapter in our book to it. Following this principle often separates organizations and leaders capable of launching new growth engines from those who set ambitious goals but fail to execute them due to too much concern about the next quarter’s results. We say much more on this in the book (available for pre-order), but here is a short excerpt on why many corporations struggle.

The average tenure of large US companies’ CEOs is around seven years. The typical horizon for VC investment is five to ten years. Could this be a clue as to why so many corporate innovation programs fail? Short-termism is sprinkled everywhere in the traditional mindset. Budgets are designed for one year. Payback time frames of more than a few years raise questioning eyebrows. Corporate executives love discussing the J‑curve, but they tend to ignore its less exciting and often painful dip into the red.

Final thought

When we embarked on the journey of writing our book, we were aware of the commitment it required. Indeed, this was a long-term project that required considerable patience! While keeping the long-term overall time frame in mind, we set and then worked diligently to meet short-term milestones, allocating time each day to writing. Embracing long-term thinking doesn’t mean overlooking the immediate impact of our actions. But we must maintain the patience to invest in projects that aren’t likely to deliver returns for 5 to 10 years. In the case of our book—although its endorsements and pre-sales are very encouraging!—we won’t truly know its impact until we can assess whether it is helping readers to make better decisions.

Whenever we’re asked for a single piece of career advice, we share this message with our students and colleagues: Prioritize your long-term value over short-term metrics, such as the initial salary or signing bonuses. Obviously, salaries are important for our livelihoods and cannot be completely disregarded, but falling into the trap of short-termism can be detrimental. Adopt a venture mindset toward your career. After all, your career is one of the most significant and thrilling projects you’ll ever undertake. Think long-term.

Stay venture-minded!

Ilya Strebulaev and Alex Dang

P.S. If you missed the previous edition of the newsletter about Networking, you can read it here.